Worker-empowering, fully functioned, data-sharing, lowest-overhead, and striving for job creation. Only public agencies have the heft, and incentive, to launch labor markets like this..

Worker-empowering, fully functioned, data-sharing, lowest-overhead, and striving for job creation. Only public agencies have the heft, and incentive, to launch labor markets like this..

.

.

Different starting point

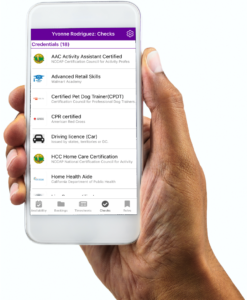

Initial videos of our GoodFlexi platform in action are here. It is not structured to maximize profits or minimize wage costs. We asked, “What should a robust, empowering, lowest-overhead, hourly-labor market look like today?” So, our platform features:

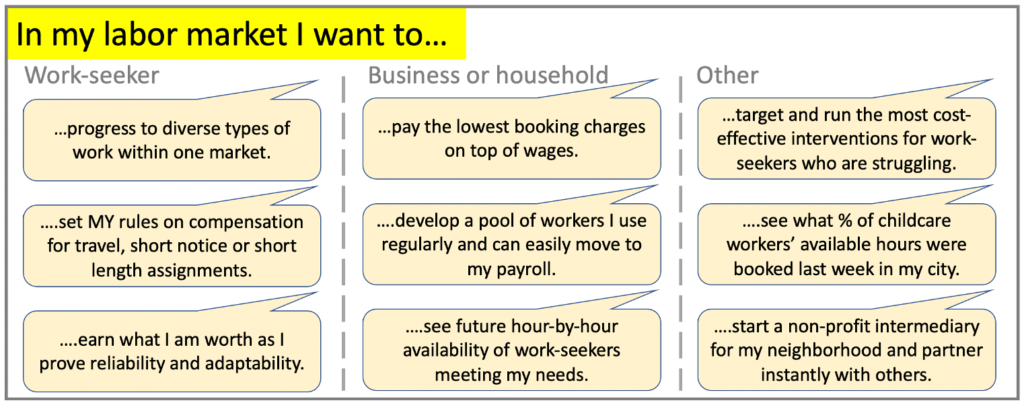

- “Horizontal” markets: Gig-work platforms and workforce scheduling tools are typically “vertical”, they serve one type of work. (Wag! For dog walking, Just Eat for deliveries, Wonolo for warehouse work, etc.) But worker opportunity comes from progressing seamlessly through multiple types of work.

- W-2 employment: A range of bodies are incentivized to become Employers-of-Record on the platform. They vet, oversee and payroll work-seekers while building relationships with client businesses or households.

Actionable data: We can produce extraordinarily granular data. How much did landscapers earn last week within 5 miles of my house? How far are medical secretaries travelling to work? What percentage of kitchen porters’ available hours were booked last month? We give this data away to the community.

Actionable data: We can produce extraordinarily granular data. How much did landscapers earn last week within 5 miles of my house? How far are medical secretaries travelling to work? What percentage of kitchen porters’ available hours were booked last month? We give this data away to the community.

- Control for users: We are not trying to enforce a business model. Our system is configured to fit the rules, priorities, terminology, and branding of each city. We recognize work-seekers can have limits on their willingness to travel, period of notice required for a booking and minimum lengths of session.

- Local accountable oversight: We are a non-profit built around open-sourcing. Labor markets for vulnerable populations should not be controlled centrally, they need local bodies in charge. That’s one reason we work with public agencies.

View a high-level brief outlining what an equitable hourly-labor platform must do here.

Different operating model

The aim of companies like Uber or Kronos/UKG and their competitors is building a valuation, or corporate efficiencies.

The aim of companies like Uber or Kronos/UKG and their competitors is building a valuation, or corporate efficiencies.

Of course, there can be trivial worker controls like turning availability on/off, setting a travel area, or shift-swopping. But building an individual path or pulling together portfolios of opportunity are near-impossible within commercial labor platforms.

Ensuring healthy labor markets is the job of government agencies, particularly in tough times. It started in the 1930’s with public labor exchanges. There are now 2,400 across the US rebadged as America’s Job Centers. When job search moved online, each state workforce agency ensured a neutral, accessible, alternative to commercial job boards.

Our markets extend the aims of public employment bodies into the flexi-work era. They have no agenda beyond sustainably; maximizing opportunity, driving local economic growth, capturing local labor market intelligence, and interfacing into government programs. That shapes a very different type of marketplace.

Different mechanism

This is where we have to get geeky. Any online market is built around a mechanism: a process by which sellers are found for a buyer, or vice versa. The mechanism determines usefulness of the market. Most commercial labor markets use one of two mechanisms:

Classified ads.: Look for a babysitter this evening on Sitter.com. The site will offer several sellers in your area who could be available and willing. Send a message to the ones you like, wait for responses, negotiate, and sort the details with your final choice. Making arrangements is time consuming and uncertain for all concerned.

Classified ads.: Look for a babysitter this evening on Sitter.com. The site will offer several sellers in your area who could be available and willing. Send a message to the ones you like, wait for responses, negotiate, and sort the details with your final choice. Making arrangements is time consuming and uncertain for all concerned.

- Algorithmic assignment: The buyer inputs a need. Immediately the market tells them which worker will fulfil it at what cost. This is generally how Uber works. TaskRabbit pivoted to this method. It’s fast and smooth for the buyer. But behind the scenes, workers are scurrying, or idle, as instructed by their phones with negligible control or ability to plan.

Seek work in a classified ads marketplace and you spend hours responding to bookings that will go to other workers. But you can at least trade across multiple markets and have some control over what bookings you accept. Sell algorithmically and you live “on call”, having to drop everything and rush off to do bookings. It’s hard to trade across multiple markets: Market A will likely withdraw future bookings if you’re busy in Market B when a buyer in A needs you.

If the aim is a vibrant, fair to everyone, labor market, and if the heft of public agencies can be used to ensure launch at scale, a further mechanism becomes viable. You will know it from the last time you booked a vacation online.

Understanding Stored Availability

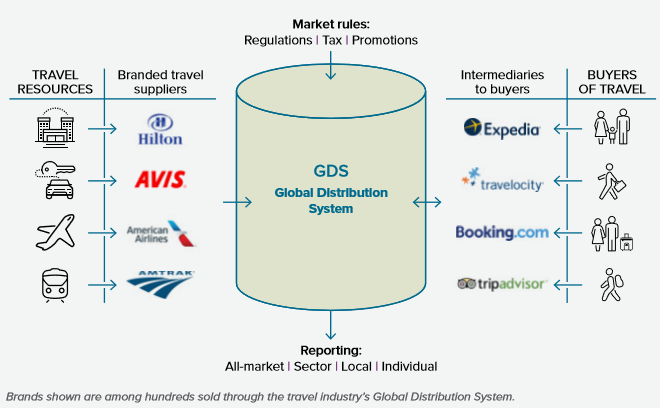

When the travel industry moved online, hotels, airlines and rental car providers collectively set up a Global Distribution System (GDS). It’s an underlying database of each asset (bedroom, seat, vehicle), when it is available, and how it is to be priced to maximize income.

When we book a trip through Expedia, Travelocity, Booking.com or other consumer apps, they are interacting with the GDS. Our charges include a mark-up for the consumer site.

The GDS puts each seller in control of their terms. It captures huge amounts of actionable data, feeding it all back to providers. But the GDS is also good for buyers. It makes booking a trip fast, reliable, and transparent. A travel-seeker on Expedia doesn’t view a list of hotels that may have availability to meet her need. Nor does the app tell her where she will stay and how much it will cost. Instead, the GDS opens up all options, ensuring quality costs more, but it will be reliably delivered.

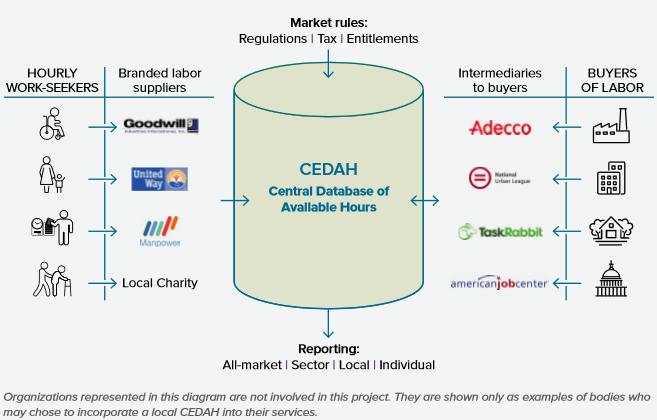

Stored Availability expanded travel. It bought in new entrants, cut overheads, fostered precision pricing to benefit sellers, and incentivized reliability. Hourly-labor markets need a comparable mechanism. That kind of platform is called a CEDAH.

Our next two pages show the GoodFlexi system configured as a CEDAH. For a detailed comparison to other hourly labor markets online, click here.

Pinpointing the differences

Looking for a point-by-point comparison with some other online labor market? Assuming it’s for lower-skilled work, rather than at-home freelancing, your point of reference is probably going be in one of these categories:

Looking for a point-by-point comparison with some other online labor market? Assuming it’s for lower-skilled work, rather than at-home freelancing, your point of reference is probably going be in one of these categories:

- Gig work platforms: There are so many, here’s a high-level list.

- “Tap-the-App staffing” for corporates:. Shiftgig, Coople, AllWork, Wonolo, Forge, Jitjatjo, WorkGenius, Stafr, Craigslist, ODS, Catapult, Blue Crew, Gigpro, Snagwork. (These services fail often, some may have closed or pivoted by the time you read this.)

- Employee scheduling tools: Kronos/UKG, Ultimate (now part of Kronos/UKG), WorkMarket (ADP), Workday, HotSchedules (Fourth), Workforce.

- Social labor exchanges: Up&Go (housecleaning in NYC) and Loconomics (local businesses in the Bay Area, now defunct) made waves. There are, or were, others. They are typically small scale, struggling to compete with the budgets and ethos of Silicon Valley rivals.

Here’s a few scenarios to test in any alternative to a CEDAH that has been launched at scale:

Why haven’t markets like we’re describing been launched already? They are, broadly, a public utility; giving away their power, charging only for a basic service, constantly opening the door to off-platform possibilities (jobs). When Silicon Valley launches a labor market they have gargantuan marketing costs in advertising and subsidies for buyers to get to critical mass. That ensures a tight focus on one vertical and high charges to recoup investment. So offering benefits and employee protections is impossible.

Public agencies have everything needed to launch a new labor market at scale with minimal paid-for marketing. But it is difficult for them to do so because of federal performance metrics for employment outcomes that incentivize traditional job creation alone. So this marginalized workforce relies on private-sector “connective tissue” to find work.

Public agencies have everything needed to launch a new labor market at scale with minimal paid-for marketing. But it is difficult for them to do so because of federal performance metrics for employment outcomes that incentivize traditional job creation alone. So this marginalized workforce relies on private-sector “connective tissue” to find work.